Introduction

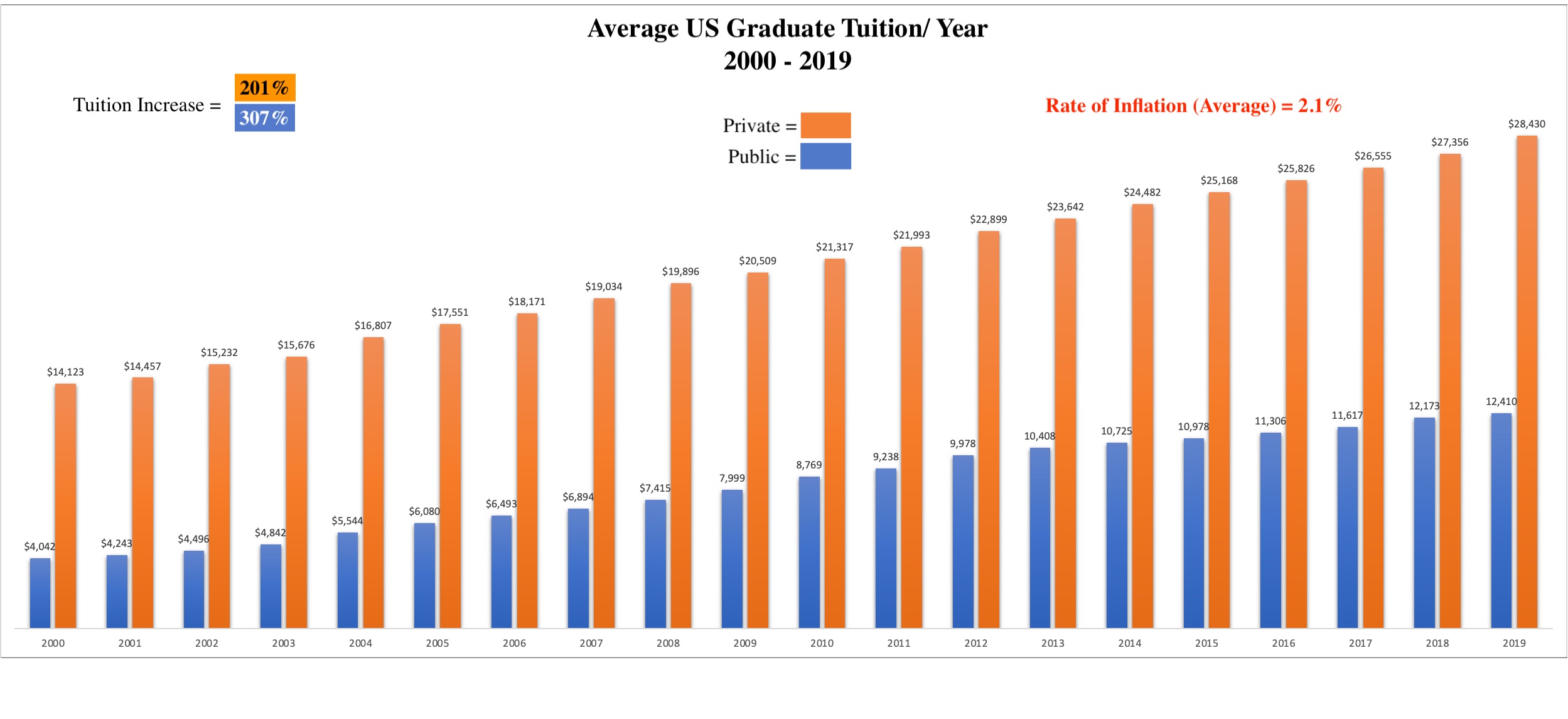

According to the U.S. Department of Education, the average public college and university graduate tuition rate in the last twenty years (2000-2019) increased 307%, from $4,042 to $12,410 per year. Private institutions rose from $14,123 to $28,430 per year, amounting to a 207% hike (U.S. Department of Education, 2021). The average inflation rate was only 2.1% (Coin News Media Group LLC, 2021). Yet, why did the tuition rate skyrocket so drastically with the inflation rate remaining so low?

Higher Education Act of 1965

Alan Collinge maintains that the initial altruistic relationship between the U.S. Department of Education, lenders, guarantors, and colleges and universities provided the breeding ground for corruption and extortion (Collinge, 2009, p. 9). In 1965, the Johnson administration passed the Higher Education Act, which provided government-secured loans to banks for students who wanted to pursue post-secondary education (Gitlen, 2021). By the end of the decade, the nation had met its goal of low-cost college education for the public. For example, in 1970, the average tuition for one year of college was $585 ($3,700 in today’s dollars). Despite the good intentions of the Higher Education Act, the financial relationship between the student and their college/university began to change.

Sallie Mae

President Nixon in 1972 signed legislation establishing the Student Loan Marketing Association (Sallie Mae), whose purpose was to encourage banks, schools, and other lenders to make loans to college students. In practice, Sallie Mae became the middle man, buying up loans from the financial industry and selling them to students via colleges and universities. Initially, Sallie Mae was a quasi-governmental agency dependent on the U.S. Treasury to secure its loans. As time went on, Sallie Mae added private investors to its portfolio as the student loan market grew throughout the 1980s, in which lenders received significant returns on their loans. By 1997, Sallie Mae privatized their portfolio, owning thirty percent of the forty-nine billion-dollar student loan market (Collinge, 2009). In 2010, the Obama administration directed all new federal loans to students to be Direct Loans (Stafford Loans) only, which cut out the private loan sector with funds from the U.S. Treasury (Rakoczy, 2020). Subsequently, the federalization of the student loan program was touted as a cost-saving measure by President Obama. Still, it was a ruse by the federal government to help fund the Affordable Care Act, with interest from the student loan program going straight into the U.S. Treasury (Wall Street Journal Editorial Board, 2016).

The Market Model

In 1974, Larry L. Leslie and Gary P. Johnson published a white paper explaining the cause of rising tuition rates and the ineffectiveness of the college and university model vs. the free-market model (Leslie & Johnson, 1974). The critique’s overall conclusion was that there is no competitive model between buyers and sellers in the college and university market, thus making the market invalid and subject to severe evaluation and revision (p.2). The researchers explain that although policymakers, government entities, and the private financial sector set up the student loan program to operate in a free market system, the result is more like a bilateral monopoly which violates any form of competitiveness between the producers (college and universities) and the consumers (the students). For example, there is no uniform market price for Higher Education. Colleges and universities attempt to sell students on qualitative criteria like the campus environment, faculty, and student amenities when the product they sell is enrollment seats. Also, the market is highly regulated by state and federal regulations and policies, limiting the number of new institutions in the market, which restricts market competition. Finally, Leslie and Johnson argued that the market’s competitiveness became completely lost when colleges and universities provided government-secured loans to students, which gave the Higher Education Market the ability to increase tuition rates with no market control (Leslie & Johnson, 1974, p. 18).

Affordable Education

The American College of Music believes the cost of graduate education should be affordable for the working music educator. Our tuition costs are very competitive due to low overhead and effective allocation of resources with no government funding. As a result, students receive more individualized attention, excellent instruction, dynamic interaction between instructors and students, and peer collaboration.

Recommendations

If you will borrow money to reach your educational goal, check out the following link to help in your decision: Student Loan Advice: 11 Tips from the Experts.

References

Coin News Media Group LLC. (2021). US Inflation Calculator. CoinNews Media Group LLC. Retrieved November 29 from https://www.usinflationcalculator.com/inflation/current-inflation-rates/

Collinge, A. (2009). The Student Loan Scam. Beacon Press.

Gitlen, J. (2021). A Look Into the History of Student Loans. LendEDU. Retrieved November 29 fromhttps://lendedu.com/blog/history-of-student-loans

Leslie, L. L., & Johnson, G. P. (1974). The Market Model and Higher Education. The Journal of Higher Education, 45(1), 1-20.

Rakoczy, C. (2020). Federal Direct Stafford Loans. Laddu. Retrieved November 29 from https://lendedu.com/blog/what-is-a-direct-federal-stafford-loan/

U.S. Department of Education. (2021). Average and percentiles of graduate tuition and required fees in degree-granting postsecondary institutions. (Table 330.50). Washington, DC: Digest of Education Statistics Retrieved from https://nces.ed.gov/programs/digest/d20/tables/dt20_330.50.asp

Wall Street Journal Editorial Board. (2016, December 1). Obama’s Giant Student-Loan Con. Wall Street Journal, 1. https://www.wsj.com/articles/obamas-giant-student-loan-con-1480640259